Sole Proprietorship

A sole proprietorship is a business run by an individual. The owner is the business; the owner has all of the profits and losses of the business. The owner also has all the control and all the liability from the business operations. Business taxes are paid by the owner through his or her personal income tax return.

Partnership

A partnership is a business which operates like a sole proprietorship, but with several individuals running it. The partners share the profits/losses, have control and liability for business operations. Partnership taxes are paid by the partners on their personal tax returns, in proportion to their share of ownership.

Corporation (or C-Corporation)

A corporation is a business which is set up as a separate legal entity from its owners. The Board of Directors makes operational decisions. Owners are protected (shielded) from liabilities of the corporation, and the corporation pays corporate income taxes.

S-Corporation (or Subchapter-S Corporation)

A small business corporation may elect to be classified as an S-Corporation, to have the liability protection of corporate status, but taxed at individual rates.

Limited Liability Company (LLC)

A limited liability company is formed by "members" whose liability is limited to their investment. An LLC is often used in place of partnerships to limit liability, while having the option of being taxed through the personal tax returns of the members.

2009年3月29日星期日

What are the 4 Cs of Credit?

A business’s creditworthiness is ultimately determined by what are known as the “4 Cs of Credit” -- character, capacity, capital and conditions -- most of which can be found explicitly or implicitly in a company’s credit report.

Character includes factors such as: size, location, number of years in business, business structure, number of employees, history of principals, appetite for sharing information about itself, media coverage, liens, judgements or pending law suits, stock performance, and comments from references.

Capacity assesses the ability of the business to pay its bills, i.e., its cash flow. It also includes the structure of the company’s debt—whether secured or unsecured—and the existence of an unused lines of credit. Any defaults must also be identified. (The second credit management "C" pertains to the skills, resources and capabilities of the customer. Therefore, capacity analysis should deal with the background of the customer in terms of innovation, business acumen, experience and knowledge in his line of business; the capability of the customer to pay on time; the capability of the customer to get paid on time himself; the level of gearing of the customer; the competitive advantage of the customer in his particular market or niche; the market share of the customer; and other pertinent data that would help in getting to better know the capabilities of the customer)

Capital assesses whether a company has the financial resources (obtained from financial records) to repay their creditors. In general, this portion of the credit report is the one most closely reviewed by the credit analyst. Heavy weighting is given to such balance sheet items as working capital, net worth and cash flow.

Conditions consider the external factors surrounding the business under consideration - influences such as market fluctuations, industry growth rate, political/ legislative factors, and currency rates.

A credit manager or loan officer will answer these questions by locating and reviewing:

-requests for credit information

-customer supplied information

-bank information

-trade information

These factors are also taken into consideration by other service providers, such as insurance companies to set premiums. More than ever, companies are using automated decisioning, which means they input scores and ratings that summarize the 4 Cs into a financial model to determine the risk of doing business with you.

Character includes factors such as: size, location, number of years in business, business structure, number of employees, history of principals, appetite for sharing information about itself, media coverage, liens, judgements or pending law suits, stock performance, and comments from references.

Capacity assesses the ability of the business to pay its bills, i.e., its cash flow. It also includes the structure of the company’s debt—whether secured or unsecured—and the existence of an unused lines of credit. Any defaults must also be identified. (The second credit management "C" pertains to the skills, resources and capabilities of the customer. Therefore, capacity analysis should deal with the background of the customer in terms of innovation, business acumen, experience and knowledge in his line of business; the capability of the customer to pay on time; the capability of the customer to get paid on time himself; the level of gearing of the customer; the competitive advantage of the customer in his particular market or niche; the market share of the customer; and other pertinent data that would help in getting to better know the capabilities of the customer)

Capital assesses whether a company has the financial resources (obtained from financial records) to repay their creditors. In general, this portion of the credit report is the one most closely reviewed by the credit analyst. Heavy weighting is given to such balance sheet items as working capital, net worth and cash flow.

Conditions consider the external factors surrounding the business under consideration - influences such as market fluctuations, industry growth rate, political/ legislative factors, and currency rates.

A credit manager or loan officer will answer these questions by locating and reviewing:

-requests for credit information

-customer supplied information

-bank information

-trade information

These factors are also taken into consideration by other service providers, such as insurance companies to set premiums. More than ever, companies are using automated decisioning, which means they input scores and ratings that summarize the 4 Cs into a financial model to determine the risk of doing business with you.

Subprime mortgage crisis and CDO&CDS

CDO:Collateralized Debt Obligation,一种债务抵押债券。

CDS:Credit Default Swap,信用违约掉期,是一种保险合约。

CDS是美国一种相当普遍的金融衍生工具,1995年首创。相当于对债权人所拥有债权的一种保险:A公司向B银行借款,B从中赚取利息;但假如A破产,B可能连本金都不保。于是由金融公司C为B提供保险,B每年支付给C保费。如果A破产,C公司保障B银行的本金;如果A按时偿还,B的保费就成了C的盈利。但是这里面隐藏着重大问题。主要是这种交易不受任何证券交易所监管,完全在交易对手间直接互换,被称为柜台交易(Over-the-counter,OTC, 柜台交易市场是在股票交易所以外的各种证券交易机构柜台上进行的股票交易市场,也就是没有集中场所的资产交易网络,又叫场外市场,也叫做柜台交易市场)也就是说在最初成交CDS时,并没有任何机制检查来保证C有足够的储备资本。这种方式后来逐渐为券商、保险公司、社保基金、对冲基金所热衷。

CDO和CDS是美国次贷危机形成的根源,形成过程为:

1、贷款公司(如房地美)游说大量美国市民贷款买房,其中包括大量次级贷款者。(低利率、零首付、房价不断上涨都是诱因)

2、贷款公司业绩取得惊人增长,但贷款公司仍可看到房地产市场的风险,于是找来投行发行债券CDO,即通过发行和销售这个CDO债券,让债券的持有人来分担房屋贷款的风险。

3、为了避免因债券风险太高而无人购买,投行把债券分成高级和普通CDO两部分,发生债务危机时,高级CDO享有优先赔付的权利。假设原来的债券风险等级是6,属于中等偏高,分拆后两部分的风险等级分别变成了4和8,总风险不变,但是前者就属于中低风险债券而形成热销。

4、剩下的等级8的高风险债券,投行卖给了对冲基金。对冲基金在全世界金融界买空卖多,崇尚高风险高回报的金融产品,于是凭借全球范围内的资源调动,在世界范围内找利率最低的银行借来钱,然后大举买入这部分普通CDO债券,2006年以前,日本央行贷款利率仅为1.5%,普通CDO利率可能达到12%,所以光靠利息差对冲基金就赚得盆满钵满。

5、美国房地产价格一路飙升,贷款公司、投行、对冲基金个个赚钱,但投行不高兴了,当初是觉得普通CDO风险太高才扔给对冲基金的,没想到对冲基金比自己赚的还多,于是投行也开始买入对冲基金打算分一杯羹了。

6、对冲基金拿着把抢手的CDO债券抵押给银行,换得10倍的贷款,然后继续大量买入投行的普通CDO。

7、随着CDO越卖越火,投行除了继续闷声买对冲基金外,又发明了新产品CDS。每年从CDO里拿出一部分利润作为保费交给保险公司,将来出了风险大家一起承担。保险公司看眼下CDO这么赚钱,自己1分钱不出都能得保费,欣然开搞。对冲基金现在已经赚了几年,虽意识到以后风险增大,但CDS有保险公司担保,所以开始大量买入CDS。于是皆大欢喜,CDS也卖火了。

8、基于CDS的基金开始发行,假设CDS已经带来了 50亿元的收益,现在新发行的这个基金是专门投资买入CDS的,显然这个建立在之前一系列产品之上的基金的风险是很高的,但是我把之前已经赚的50亿元投入作为保证金,如果这个基金发生亏损,那么先用这50亿元垫付,只有这50亿元亏完了,你投资的本金才会开始亏损,而在这之前你是可以提前赎回的,首发规模500亿元。1元面值买入的基金,亏到0.90元都不会亏自己的钱,赚了却每分钱都是自己的!评级机构看到这个天才设想,毫不犹豫给予AAA评级!结果这个基金卖疯了,各种养老基金、教育基金、理财产品,甚至其他国家的银行也纷纷买入。虽然首发规模是原定的500亿元,可是后续发行了多少亿,已经无法估算,但保证金50亿元却没有变。如果现有规模5000亿元,那保证金就只能保证在基金净值不低于0.99元时你不会亏钱了。

以上情况均建立在房地产市场繁荣的前提下,一旦房价下跌,这个金字塔就轰然倒塌了。受影响的主体包括贷款公司、投行、银行、对冲基金、保险公司和所有其他买入CDS、CDO和基于此的基金的公司。

CDS:Credit Default Swap,信用违约掉期,是一种保险合约。

CDS是美国一种相当普遍的金融衍生工具,1995年首创。相当于对债权人所拥有债权的一种保险:A公司向B银行借款,B从中赚取利息;但假如A破产,B可能连本金都不保。于是由金融公司C为B提供保险,B每年支付给C保费。如果A破产,C公司保障B银行的本金;如果A按时偿还,B的保费就成了C的盈利。但是这里面隐藏着重大问题。主要是这种交易不受任何证券交易所监管,完全在交易对手间直接互换,被称为柜台交易(Over-the-counter,OTC, 柜台交易市场是在股票交易所以外的各种证券交易机构柜台上进行的股票交易市场,也就是没有集中场所的资产交易网络,又叫场外市场,也叫做柜台交易市场)也就是说在最初成交CDS时,并没有任何机制检查来保证C有足够的储备资本。这种方式后来逐渐为券商、保险公司、社保基金、对冲基金所热衷。

CDO和CDS是美国次贷危机形成的根源,形成过程为:

1、贷款公司(如房地美)游说大量美国市民贷款买房,其中包括大量次级贷款者。(低利率、零首付、房价不断上涨都是诱因)

2、贷款公司业绩取得惊人增长,但贷款公司仍可看到房地产市场的风险,于是找来投行发行债券CDO,即通过发行和销售这个CDO债券,让债券的持有人来分担房屋贷款的风险。

3、为了避免因债券风险太高而无人购买,投行把债券分成高级和普通CDO两部分,发生债务危机时,高级CDO享有优先赔付的权利。假设原来的债券风险等级是6,属于中等偏高,分拆后两部分的风险等级分别变成了4和8,总风险不变,但是前者就属于中低风险债券而形成热销。

4、剩下的等级8的高风险债券,投行卖给了对冲基金。对冲基金在全世界金融界买空卖多,崇尚高风险高回报的金融产品,于是凭借全球范围内的资源调动,在世界范围内找利率最低的银行借来钱,然后大举买入这部分普通CDO债券,2006年以前,日本央行贷款利率仅为1.5%,普通CDO利率可能达到12%,所以光靠利息差对冲基金就赚得盆满钵满。

5、美国房地产价格一路飙升,贷款公司、投行、对冲基金个个赚钱,但投行不高兴了,当初是觉得普通CDO风险太高才扔给对冲基金的,没想到对冲基金比自己赚的还多,于是投行也开始买入对冲基金打算分一杯羹了。

6、对冲基金拿着把抢手的CDO债券抵押给银行,换得10倍的贷款,然后继续大量买入投行的普通CDO。

7、随着CDO越卖越火,投行除了继续闷声买对冲基金外,又发明了新产品CDS。每年从CDO里拿出一部分利润作为保费交给保险公司,将来出了风险大家一起承担。保险公司看眼下CDO这么赚钱,自己1分钱不出都能得保费,欣然开搞。对冲基金现在已经赚了几年,虽意识到以后风险增大,但CDS有保险公司担保,所以开始大量买入CDS。于是皆大欢喜,CDS也卖火了。

8、基于CDS的基金开始发行,假设CDS已经带来了 50亿元的收益,现在新发行的这个基金是专门投资买入CDS的,显然这个建立在之前一系列产品之上的基金的风险是很高的,但是我把之前已经赚的50亿元投入作为保证金,如果这个基金发生亏损,那么先用这50亿元垫付,只有这50亿元亏完了,你投资的本金才会开始亏损,而在这之前你是可以提前赎回的,首发规模500亿元。1元面值买入的基金,亏到0.90元都不会亏自己的钱,赚了却每分钱都是自己的!评级机构看到这个天才设想,毫不犹豫给予AAA评级!结果这个基金卖疯了,各种养老基金、教育基金、理财产品,甚至其他国家的银行也纷纷买入。虽然首发规模是原定的500亿元,可是后续发行了多少亿,已经无法估算,但保证金50亿元却没有变。如果现有规模5000亿元,那保证金就只能保证在基金净值不低于0.99元时你不会亏钱了。

以上情况均建立在房地产市场繁荣的前提下,一旦房价下跌,这个金字塔就轰然倒塌了。受影响的主体包括贷款公司、投行、银行、对冲基金、保险公司和所有其他买入CDS、CDO和基于此的基金的公司。

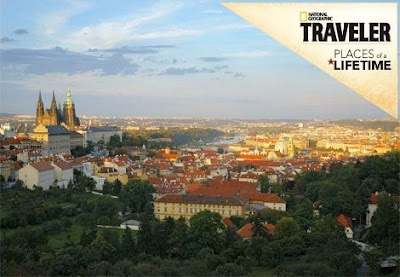

The world's top destinations recommended by National Geographic

Shanghai/Today’s Shanghai is a model of progress—not just in China but in all the world. In just a few short decades, the city—known in pre-communist years for its glitz and glamour—has reestablished itself as one of Asia’s most vibrant, forward-thinking, and cosmopolitan places to visit. “This is a city with its foot on the accelerator 24 hours a day, blasting off into the future at speeds that leave little time for nostalgia,” says local journalist Richard Baimbridge. But if you really want nostalgia, among the thrumming nightlife and gourmet restaurants, Shanghai has that, too: Neoclassical architecture, Mao memorabilia, historic museums, authentic food down gritty alleyways—all these and more await.

Shanghai/Today’s Shanghai is a model of progress—not just in China but in all the world. In just a few short decades, the city—known in pre-communist years for its glitz and glamour—has reestablished itself as one of Asia’s most vibrant, forward-thinking, and cosmopolitan places to visit. “This is a city with its foot on the accelerator 24 hours a day, blasting off into the future at speeds that leave little time for nostalgia,” says local journalist Richard Baimbridge. But if you really want nostalgia, among the thrumming nightlife and gourmet restaurants, Shanghai has that, too: Neoclassical architecture, Mao memorabilia, historic museums, authentic food down gritty alleyways—all these and more await. Hongkong/A frantic, hurly-burly mixture of capitalism and exoticism, Hong Kong has been called the “most thrilling city on the planet.” Change is the constant in this city of 6.9 million. Its main attractions lie in Kowloon, which juts from the tip of southern China, and on Hong Kong Island, with its Central downtown district, just across the harbor. The island of Lantau is home to the airport and several large country parks. Outlying islands are less densely populated but readily accessible. An extensive transportation network linking the city’s various districts include tunnels, ferries, subways, and, of course, taxis, which are plentiful and cheaper than those in comparably sized cities.

Hongkong/A frantic, hurly-burly mixture of capitalism and exoticism, Hong Kong has been called the “most thrilling city on the planet.” Change is the constant in this city of 6.9 million. Its main attractions lie in Kowloon, which juts from the tip of southern China, and on Hong Kong Island, with its Central downtown district, just across the harbor. The island of Lantau is home to the airport and several large country parks. Outlying islands are less densely populated but readily accessible. An extensive transportation network linking the city’s various districts include tunnels, ferries, subways, and, of course, taxis, which are plentiful and cheaper than those in comparably sized cities. Los Angeles/“Welcome to the Jungle,” famously sang the band Guns N' Roses. Situated on a wide, dry plain speckled with canyons, mountains, rivers, and beaches, vast and beautiful Los Angeles, California, is anything but a jungle in topography. And even though some jungle-like qualities can emerge, such as during rush hour on the 405, to a visitor the city is a sunny, friendly place, filled with its own rich lore—stories that range from the days of the Spanish missions to the latest gossip about Hollywood stars. History oozes from the streets and buildings of L.A. All you need do is look around and listen.

Los Angeles/“Welcome to the Jungle,” famously sang the band Guns N' Roses. Situated on a wide, dry plain speckled with canyons, mountains, rivers, and beaches, vast and beautiful Los Angeles, California, is anything but a jungle in topography. And even though some jungle-like qualities can emerge, such as during rush hour on the 405, to a visitor the city is a sunny, friendly place, filled with its own rich lore—stories that range from the days of the Spanish missions to the latest gossip about Hollywood stars. History oozes from the streets and buildings of L.A. All you need do is look around and listen. Moscow/This massive metropolis captures Russia at her most extreme: her communist austerity and her capitalist indulgence; her devout orthodoxy and her uninhibited displays of wealth and power; her enigmatic ancient history and her dazzling contemporary culture. Moscow is the seat of political power in Russia, but it is also the country’s cultural and commercial center. From the storied streets surrounding Red Square to the modern new Moscow-City, the Russian capital is crammed with artistic, historic, and otherwise sacred sites. Sometimes intellectual and inspiring, sometimes debauched and depraved, it is always eye-opening.

Moscow/This massive metropolis captures Russia at her most extreme: her communist austerity and her capitalist indulgence; her devout orthodoxy and her uninhibited displays of wealth and power; her enigmatic ancient history and her dazzling contemporary culture. Moscow is the seat of political power in Russia, but it is also the country’s cultural and commercial center. From the storied streets surrounding Red Square to the modern new Moscow-City, the Russian capital is crammed with artistic, historic, and otherwise sacred sites. Sometimes intellectual and inspiring, sometimes debauched and depraved, it is always eye-opening. Prague/Prague's intact medieval Old Town connects to an equally well-preserved Lesser Quarter by way of a 14th-century stone bridge—all brooded over by a castle that’s part Disneyland and part Franz Kafka. In the 1989 Velvet Revolution, this “city of 100 spires” (more like 500) awoke like a modern-day Rip Van Winkle in the heart of Europe—shrugging off decades of slumber under first the Nazis and then the Communists and, centuries before that, the Habsburgs. Prague drips with history, but it’s hardly a museum piece. The booming tourist industry has fed a revival of the city’s arts and museums, and made its hotels and restaurants the envy of Central Europe.

Prague/Prague's intact medieval Old Town connects to an equally well-preserved Lesser Quarter by way of a 14th-century stone bridge—all brooded over by a castle that’s part Disneyland and part Franz Kafka. In the 1989 Velvet Revolution, this “city of 100 spires” (more like 500) awoke like a modern-day Rip Van Winkle in the heart of Europe—shrugging off decades of slumber under first the Nazis and then the Communists and, centuries before that, the Habsburgs. Prague drips with history, but it’s hardly a museum piece. The booming tourist industry has fed a revival of the city’s arts and museums, and made its hotels and restaurants the envy of Central Europe.

订阅:

评论 (Atom)